Salary Calculation Formula Malaysia

However the adoption of any other method or. Search for jobs related to Malaysia salary calculation formula or hire on the worlds largest freelancing marketplace with 20m jobs.

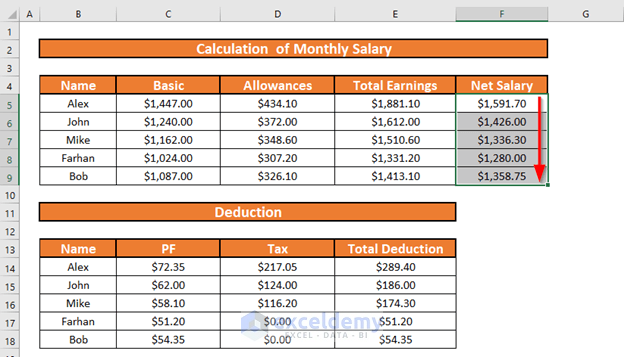

Salary Formula Calculate Salary Calculator Excel Template

Input the Basic Salary Allowances.

. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your. Calculate the Gross Salary and Net Salary of the following salary components. January has 31 days example for easy calculation working days are required to subtract PH and Sunday Salary Deduction for incomplete month.

An employer may adopt any method or formula other than the above method or formula for calculating the OPR of an employee. A The formula for calculating OT amount in our system. Salary Formula as follows.

How do I calculate annual leave in Excel. Annual Salary after deductions is the total amount of salary calculator remaining after the total deductions are made on the employees gross annual salary. Search for jobs related to Malaysia salary calculation formula or hire on the worlds largest freelancing marketplace with 21m jobs.

This will calculate the combined tax for both salary and bonus in the payslip after that you may deduct the tax of the monthly salary component to get the bonus-only tax. Gross Salary 432000 43200 86400 10800. Gross Salary is calculated as.

Over the course of a year of 365 days the employee would accrue 1476 days or 1181 hours of leave which is equal to 251 work days. An employee weekly rate of pay is 6. Paying employee wages late.

Divide the employees daily salary by the number of normal working hours per day. Then calculate the overtime pay rate by multiplying the hourly rate by 15 and then. Insert your salary to discover your take home pay.

You can edit the preset OT rates and also create new OT rates by clicking on Add Custom Rate. RM2000 3 31. Working Hours Wages Malaysia Subject Formula Example Ordinary rate of pay daily pay Monthly pay eg minimum wage number of working days ordinary rate of pay RM1000.

Its free to sign up and bid on jobs. Malaysia Monthly Salary After Tax Calculator 2022. RM50 8 hours RM625.

Payroll Cycle If you. This salary calculator is applicable for monthly wages up to RM20000 and shows estimates only. Tax rates range from 0 to 30.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Salary calculator Malaysia 2020 provides wages information to the user based on laws calculation for payroll software in Malaysia. Salarycal is a useful Android device app that lets you compute your salary by also deducting your other monthly expenses such as.

An employee monthly rate of pay is always fixed to 26. How to Perform Salary Calculator Malaysia. The PCB calculator 2021 in Actpay is approved by LHDN Malaysia and has 100 calculation accuracy verified repeatedly over the last 5 years.

The employees share of the EPF. Its free to sign up and bid on jobs. According to the Employment Act 1955 employers are required to payout monthly wages on the seventh day of the following month.

Salarycal Salary Calculator Malaysia. Salary Formula Example 3.

Salary Formula Calculate Salary Calculator Excel Template

How To Create A Monthly Salary Sheet Format In Excel With Easy Steps

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

0 Response to "Salary Calculation Formula Malaysia"

Post a Comment